Restoration Tax Credit

Restoration Tax Credit

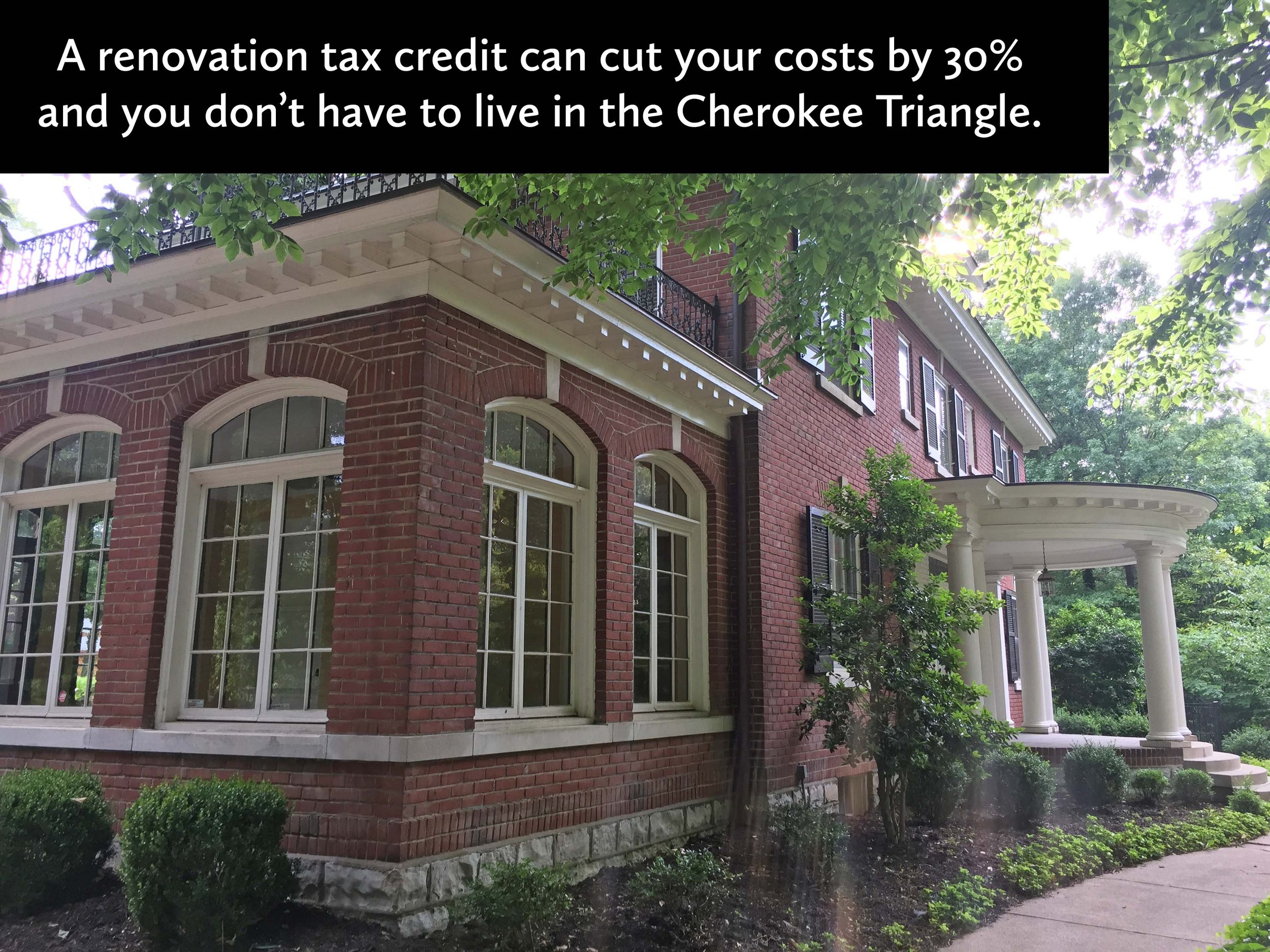

If a home is in a Metro Louisville Landmark District and/or a National Register District, renovations may be eligible for a 30% Kentucky Historic Preservation Tax Credit. If you were to spend $40,000 remodeling an eligible home, you could receive about $12,000 off your state taxes for that year and any succeeding years until the credit is used up. In 2020, the state began to allocate $100 million to pay out each year. The prior allotment was just $5 million per year so this was a big change.

The minimum project is $20,000 over a two-year or less period approved in advance of any work being done. The maximum project size is $200,000 which could receive a $60,000 tax credit. There is also a commercial version of the historic renovation tax credit. We've done it twice for our own home and would be happy to tell you more.

To find out whether a Jefferson County property is in an eligible district, click here and zoom in on the map to any of the blue areas. If your home is within one of those areas, you may be eligible. Especially if the home is old and typical of the other homes in that area.

For more information on the Kentucky state program call:

Katherine Wilborn

Site Development Program Administrator

502-892-3446

Email: Katherine Wilborn

Website

For info on rules for projects involving any changes at all to the exterior of buildings in Louisville’s Landmark Districts (does not apply to all National Register areas), contact Historic Preservation & Urban Design.

Planning & Design

(502) 574-6230

Website